Uber Stock Tumbles After $5.2b Loss, Sales Miss Estimates

Uber Technologies Inc. failed to assure investors Thursday of its growth potential or that it can turn a profit anytime soon. The ride-hailing company reported second-quarter adjusted sales that fell short of estimates and posted a net loss of $5.24 billion, by far the largest ever for the business.

Most of that loss was attributed to stock-based compensation associated with the initial public offering in May, a routine expense for newly public companies. The adjusted loss—a more commonly used metric for ride-hailing companies, which excludes interest, tax and other expenses—more than doubled to $656 million but wasn’t as large as the $979.1 million analysts expected.

What really raised concerns, though, was Uber’s disappointing sales growth. Adjusted revenue in the second quarter increased 12% from a year earlier, the slowest rate in the company’s history. The San Francisco-based company generated $2.87 billion in adjusted revenue for the second quarter, below estimates of $3.05 billion, according to data compiled by Bloomberg.

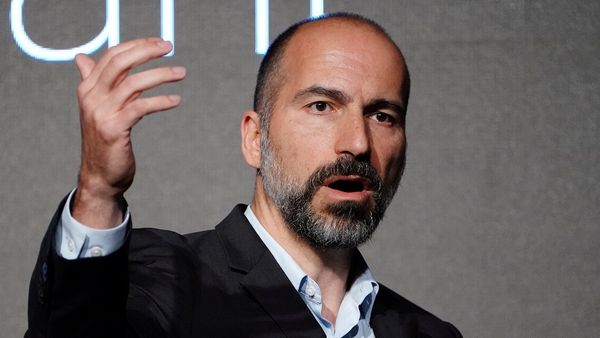

Uber hasn’t even been public for three months, but investors are wondering how long it can keep growing. Dara Khosrowshahi, the chief executive officer, suggested the business had a broader problem with bloat last week, when the company said it would cut about 400 employees in marketing.

On a call with reporters Thursday, Khosrowshahi acknowledged those concerns, while defending the business as one with “growth rates that companies at our scale would kill for.” However, he said, “the law of large numbers at some point will catch up with you.”

Khosrowshahi emphasized signs of growth potential during a conference call following the report. Gross bookings, a number used to track customer demand, rose 31% to $15.76 billion. Uber expects to maintain that growth rate for the year, forecasting $65 billion to $67 billion in gross bookings.

On Wednesday, Lyft Inc. reported loss and revenue figures that both exceeded estimates and boosted its annual forecast. Lyft, which operates the No. 2 ride-hailing app in the U.S., indicated that the price war with Uber is abating and that the company expects to lose less this year than in 2018, which was welcome news to investors. Both stocks saw a bump as a result, but much of Uber’s gains were wiped out after it reported results. The stock was down about 6% in extended trading Thursday.

Khosrowshahi confirmed that the battle for market share is easing. “We’re definitely seeing the competitive environment improve,” he said. Still, Uber forecasts an adjusted loss of $3 billion to $3.2 billion this year. “We think that 2019 will be our peak investment year,” Khosrowshahi said. “In 2020, 2021, you’ll see losses come down.”

Bloomberg

Indian Food Delivery Unicorn Zomato Likely To File For IPO Next Month

Food delivery unicorn Zomato is planning to file for an Initial Public Offering (IPO) by April which could raise $65... Read more

Vietnams Bamboo Airways Aims Third-quarter Listing With Market Cap Of $2.73b

Vietnam’s startup Bamboo Airways said on Friday it aimed to list its shares on a local stock exchange in the thi... Read more

Didi Chuxing Advances IPO Plans To Next Quarter, Targets $62b Valuation

Chinese ride-hailing giant Didi Chuxing Technology Co. is accelerating plans for an initial public offering to as early... Read more

Warburg-backed Kalyan Jewellers IPO Loses Shine, Sees Tepid Demand

Kalyan Jewellers India Ltd’s initial public offering was oversubscribed by just 1.28 times on Thursday, a sign of tep... Read more

Chinese E-commerce Platform DMall Hires Banks For Over $500m US IPO

Chinese e-commerce platform Dmall (Beijing) E-commerce Co has hired Bank of America, Goldman Sachs and JPMorgan for a... Read more

Tencent-backed Chinese Software Firm Tuya Eyes $915m In US IPO

Tuya Inc., a software company backed by New Enterprise Associates and Tencent Holdings Ltd., is on track to raise $915 ... Read more