SoftBank Seen Returning To Profitability Despite Significant Losses

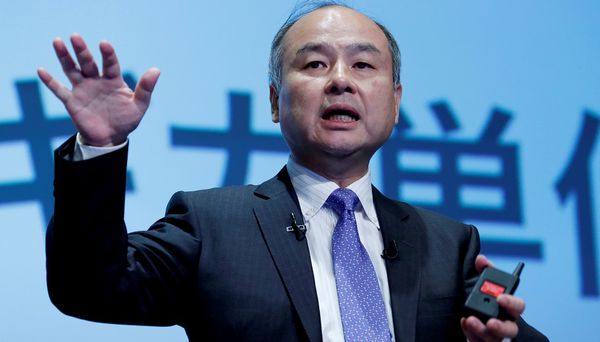

SoftBank Group Corp is seen booking a 75% first-quarter profit plunge on Tuesday, albeit making a return to profitability, as the coronavirus outbreak continued to weigh on the tech bets of CEO Masayoshi Son’s $100 billion Vision Fund.

The Japanese conglomerate is expected to record operating profit of 171 billion yen ($1.62 billion) for April-June, showed the average of three analyst estimates compiled by Refinitiv. That would compare with 625 billion yen in the same period a year earlier.

Analysts grapple with uncertainty over how the Vision Fund values its portfolio of mostly unlisted technology firms. Faltering bets on startups such as shared office space firm WeWork pushed SoftBank to its deepest annual loss last year.

The performance of the Vision Fund’s public assets is likely to return SoftBank to profit in the first quarter, said analyst Kirk Boodry at Redex Research. Positive news include insurance startup Lemonade Inc’s LMND.N successful July listing.

Chief Executive Son has pivoted as plans faltered, jettisoning satellite operator OneWeb and launching a share buy-back funded by asset sales to support SoftBank’s share price.

The group has sold down stakes in e-commerce firm Alibaba Group Holding Ltd and wireless carriers SoftBank Corp and T-Mobile US Inc.

It is also looking at selling chip designer Arm, media reported, in a possible break from a firm Son praised as closely aligned with his vision but that has turned money losing under his watch.

SoftBank has struggled to attract capital for a second mega-fund given poor performance of the first and so has been investing its own money.

“With the amount of assets that have been sold, the next logical step is to move forward on Vision Fund 2,” Boodry said.

The value of SoftBank’s assets has returned to pre-coronavirus levels, Son said in June, referring to his preferred measure of success.

Reuters

Indian Food Delivery Unicorn Zomato Likely To File For IPO Next Month

Food delivery unicorn Zomato is planning to file for an Initial Public Offering (IPO) by April which could raise $65... Read more

Vietnams Bamboo Airways Aims Third-quarter Listing With Market Cap Of $2.73b

Vietnam’s startup Bamboo Airways said on Friday it aimed to list its shares on a local stock exchange in the thi... Read more

Didi Chuxing Advances IPO Plans To Next Quarter, Targets $62b Valuation

Chinese ride-hailing giant Didi Chuxing Technology Co. is accelerating plans for an initial public offering to as early... Read more

Warburg-backed Kalyan Jewellers IPO Loses Shine, Sees Tepid Demand

Kalyan Jewellers India Ltd’s initial public offering was oversubscribed by just 1.28 times on Thursday, a sign of tep... Read more

Chinese E-commerce Platform DMall Hires Banks For Over $500m US IPO

Chinese e-commerce platform Dmall (Beijing) E-commerce Co has hired Bank of America, Goldman Sachs and JPMorgan for a... Read more

Tencent-backed Chinese Software Firm Tuya Eyes $915m In US IPO

Tuya Inc., a software company backed by New Enterprise Associates and Tencent Holdings Ltd., is on track to raise $915 ... Read more