About two years after Blackstone Group LP registered India’s first real estate investment trust, the private equity giant is close to taking it public. Rising interest rates threaten to get in the way.

Blackstone and local partner Embassy Group plan to file a prospectus for an initial public offering of the REIT as early as next month, a deal that may raise as much as $1 billion, people with knowledge of the matter said. Even so, the listing could be delayed should investors demand a higher-than-expected yield, according to the people, who asked not to be identified as the information is private.

A successful listing of Blackstone’s REIT would send a hopeful message to India’s cash-starved property companies, who are still recovering from sweeping policy changes over the past two years and struggling for new loans. However, rising returns from safe instruments such as government bonds are pushing investors to seek higher payouts from riskier ones like REITS.

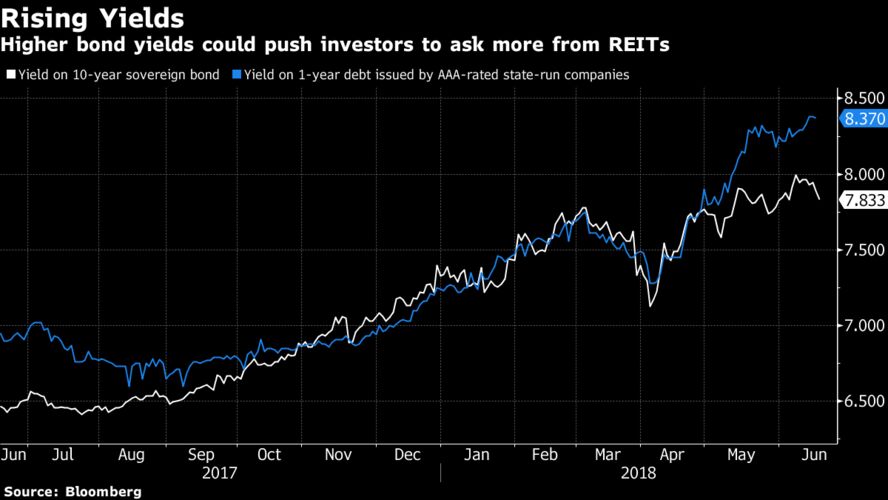

Investors may demand yields as high as 15 percent to subscribe to the Blackstone offering, said Devendra Singhvi, Mumbai-based head of fixed income at Aditya Birla Sun Life Insurance Co. That’s almost double what 10-year Indian government bonds yield.

Blackstone’s REIT is focused on commercial real estate and is said to include properties that count Rolls Royce Holdings Plc and Microsoft Corp. as tenants. This could render it less vulnerable to rising rates given that India’s seeing a revival in the commercial segment of the property market.

Demand for office space grew 23 percent year-on-year in the first quarter of 2018 after a 5.7 percent gain the same period last year, data from Colliers International show. Appreciation of a REIT’s underlying assets, together with the yield, would boost total returns for investors.

Holding a REIT unit for 10 years may generate returns as high as 15 percent annually, said S. Sriniwasan, managing director of Kotak Investment Advisors. “There will be good demand from evolved and patient investors who understand the yield-plus growth fundamental driving the total return that this product offers.”

A Blackstone representative declined to comment. The Business Standard newspaper had previously reported about a possible listing.

Long Gestation

REITs have been in the making for about half a decade in India, as the regulator kept tweaking rules. Investors have to pay 30 percent short-term capital gains tax on REITs in India compared with zero in Hong Kong, Singapore and Indonesia. The minimum initial investment of 200,000 rupees ($3,000) is also a deterrent for retail investors.

Moreover, investors are wary of these products after much-hyped infrastructure investment trusts failed to meet market expectations. IRB InvIT Fund has plummeted about 22 percent and India Grid Trust declined 3 percent since their listings last year.

“If InvITs have not done well, there will definitely be an impact on REITs,” said Sandeep Upadhyay, chief executive officer of Centrum Infrastructure Advisory Ltd. He predicts REIT investors will seek a premium of at least 3 percentage points over the 7.86 percent sovereign 10-year bond yield.

Surabhi Arora, senior analyst at property services firm Colliers, says Indian REITs will be unable to pay much above 9 percent, given that the overall property market is still recovering.

It was hit in 2016 by the Indian government’s shock decision to clamp down on cash transactions. Home sales plunged to a seven-year low, leaving developers grappling with debt and banks clamped down further on lending. Bank loans to commercial real estate rose less than 0.5 percent in the two years through April 2018 while overall non-food credit increased almost 16 percent.

(By Rahul Satija, Dhwani Pandya, Anto Antony)

With assistance by Sree Vidya Bhaktavatsalam

Also Read:

Blackstone raises over $9b for Asia-focused real estate, PE funds

IIFL Holdings registers REIT with regulator after Embassy, Blackstone

Bloomberg